The Benefit Resources, Inc. (BRI) Board of Directors report to the 43rd General Assembly of its work during 2022-2023, plus recommendations for consideration by the Assembly.

Use these quicklinks to navigate to a specific section of this report:

Summary of Work

Summary of Recommendations

Work of the Committee

Recommendations (Detailed)

Committee Members

Meeting Dates

Randy Shaneyfelt

Chairman

RE, Presbytery of the Great Plains

SUMMARY OF WORK

1. Health and Wellness: Our members and their churches experienced an average 6.5% premium rate increase for 2023. Since 2020, premiums have increased by an average of just of just 4.5%. This is well below the 8.0% rate of general medical cost inflation during that period.

2. Retirement: Participation in our plan, which is open to all clergy and non-clergy staff, has grown by 323 members since 2019.

3. General Operations and Administration: Advice and counsel are provided through membership in the Church Benefit Association, Church Alliance, and use of legal counsel, actuary, and consultants specializing in Retirement Plan and Benefits Administration.

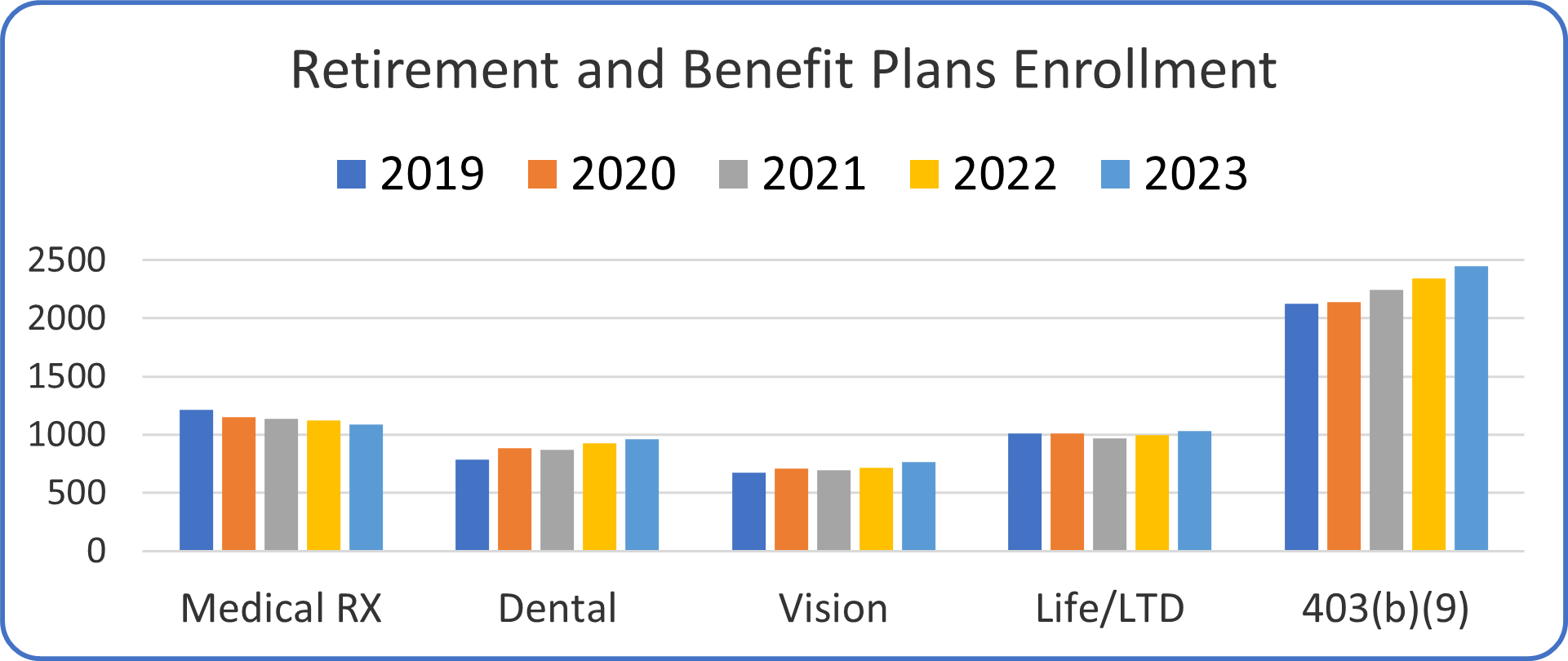

4. Participation Overview: Benefit plan enrollments have been fairly stable for the last 5 years with our Health and Life benefit plans, with steady participation growth showing in the Dental Plan and Retirement Plan participation.

5. Medical/Prescription Drug Benefits: We understand that member EPC churches and staff have varying needs when it comes to medical coverage. That’s why we offer 5 plans: Platinum, Gold, Silver POS Plans, plus Gold and Bronze High Deductible Health Plans with Health Savings Plan options. These plans offer a wide spectrum of premium and participant cost-sharing levels.

6. Member Health/Wellness and Member Care Focus: BRI has implemented the Livongo Whole Person Health program to coach and provide practical resources to those with diabetes, pre-diabetes, and high blood pressure. BRI has also added a Nurse Health Coaching program to provide education and support to participants with other conditions such as chronic pain, arthritis, high cholesterol, asthma, and various lung, heart, and kidney diseases. These programs are available at no cost to EPC Plan participants. The EPC Benefits website contains a wealth of information on these programs.

7. EPC Retirement Plan: Collectively, our members held more than $177 million in their retirement accounts, or an average balance of about $72,000 per participant (as of December 2022). Nearly half of the value of members’ accounts is invested in Retirement Target Date (Life Cycle) funds. These funds automatically and gradually reduce members’ exposure to investment risks as they approach retirement.

RECOMMENDATIONS

43-12 That ordained ministers drawing retirement income from the EPC 403(b)(9) Defined Contribution Retirement Plan be allowed to designate up to 100% of their retirement income for housing allowance as permitted by applicable regulations adopted pursuant to the Internal Revenue Code.

WORK OF THE COMMITTEE

EPC BRI’s vision is to improve the physical and financial well-being of pastors, their families, and eligible lay employees in Christian ministry that they may be better equipped to fulfill their callings. Our mission encourages plan participants to improve their health, wellness, and retirement security.

To fulfill our mission, we provide a complete suite of benefits that meet participants’ needs at a competitive cost that are portable, convenient, and consistent with EPC values and EPC BRI fiduciary responsibilities. Our goal is to accomplish this mission by providing competitive benefit plans, maintaining plan and price stability, encouraging use of wellness programs, and by achieving above-benchmark-performing retirement plan returns with flexible distributions options. And to do this through a structure of efficient and cost-effective premiums and expenses. We also seek to create high member support, participation, and satisfaction.

In pursuing the mission of EPC Benefit Resources, Inc., we humbly submit the following report of the plans, activities, and results for the last year:

HEALTH AND WELLNESS

• Our members and their churches experienced an average 6.5% premium rate increase for 2023. Since 2020, premiums have increased by an average of just of just 4.5%. This is well below the 8.0% rate of general medical cost inflation during that period.

• The wellness profile of EPC members reveals health status concerns that impact the joy of life and risk of future medical claim cost. We have implemented and have members participating in programs to help them address these conditions.

• We must note that some EPC churches still do not participate in the medical plan. As described further in this report, our EPC medical plan provides excellent coverage through a top-tier nationwide network of quality hospitals and providers. As a self-insured plan, the premiums our churches and members pay are used exclusively to provide medical care for our members, and the plans offered reflect our values as Christians. In effect, EPC member congregations are a sharing network for each other’s medical costs. We strongly encourage all churches to consider participating to support one another in ministry.

RETIREMENT

• Our Plan is a 403(b)(9) Defined Contribution church plan, and ordained pastors retain the ability to claim up to 100% of their annual retirement withdrawals as income tax free Housing Allowance, even into retirement.

• Participation in our plan, which is open to all clergy and non-clergy staff, has grown by 323 members since 2019.

• Globally, investment markets were faced with significant challenges in 2022. In a year in which the Standard and Poor’s 500 Index (S&P 500) declined 18.1%, the Russell 2000 declined 20.4%, and even the index of US Treasury Bonds declined 12.9%, it was not surprising to see the overall return of our members was down 17.2%. In fact, only one other time in history have fixed income and equity markets both declined over a 12-month period. We were pleased that we did not see investor panic among our members. Only 10% of member accounts made fund exchanges during the year, indicating that members of the plan take a long-term perspective to their retirement funds. And they have been rewarded for staying invested, as the S&P 500 index has risen 6.9% through April 25, 2023.

• Many members took advantage of free consultation with Fidelity representatives, the educational webinars, and other financial planning tools offered through BRI and available on their personal account log-in on Fidelity’s NetBenefits webpage.

GENERAL OPERATIONS AND ADMINISTRATION

• EPC Benefit Resources, Inc., financial statements are audited annually by independent accounting firm Batts, Morrison, Wales, and Lee, Certified Public Accountants. The audited statements are presented to the BRI Board of Directors and the Office of General Assembly.

• Advice and counsel are provided through membership in the Church Benefit Association, Church Alliance, and use of legal counsel, actuary, and consultants specializing in Retirement Plan and Benefits Administration.

• The BRI Office and Office of the Stated Clerk often receive inquiries regarding the requirements for participation in EPC Benefit Plans as mandated by the Acts of Assembly. The Acts clearly express the intent that benefits-eligible EPC pastors and staff should be provided with medical coverage through the denominational medical plan. Although there are many Acts that reference EPC medical and retirement programs, key Acts include 81-04, which mandates participation of EPC ministers, and 84-08, which mandates benefit-eligible ministers’ and employees’ participation in the denominational plan.

PARTICIPATION OVERVIEW

Just over 3,000 participants are enrolled in the EPC Medical Plan, including 1,098 clergy and staff and nearly 2,000 dependents. A total of 2,438 active clergy, staff, and retirees were enrolled in the EPC Retirement Plan at the end of 2022. The chart below reflects employee enrollments (without dependents), which have been fairly stable for the last 5 years with our Health and Life benefit plans and steady participation growth in the Dental Plan and the Retirement Plan.

All full-time clergy and staff at EPC churches and EPC-associated ministries are eligible to participate in the benefit plans sponsored by BRI. Higher participation advantages all members and their sponsoring churches. If your church has not taken advantage of these important benefit offerings for your clergy and staff, or if you would simply like to explore the benefits offerings and costs, we welcome your inquiry to our Executive Director at 407-930-4507 or benefits@epc.org.

MEDICAL/PRESCRIPTION DRUG BENEFITS

The EPC Medical Plan is our plan, not a plan we adopted from an insurance company. What’s covered under the plan is controlled by the EPC, and importantly, services and medications that run counter to our beliefs are not covered.

Five new churches joined the plan with 2023 enrollment.

We understand that member EPC churches and staff have varying needs when it comes to medical coverage, that’s why we offer 5 plans: Platinum, Gold, Silver POS Plans, plus Gold and Bronze High-Deductible Health Plans with Health Savings Plan options. These plans offer a wide spectrum of premium and participant cost-sharing levels.

Premiums increased an average of 6.5% in 2023, with no changes in co-pays or deductibles. Our Medical Plan has a very solid financial foundation, assuring us that our members’ medical expenses will be covered. The EPC maintains stop-loss insurance and a $6.9 million medical reserve fund (as of March 31, 2023) as protection against catastrophic claims.

Twenty individuals covered by our plan incurred more than $100,000 each in medical costs during 2022. A health crisis can arise for any of us at any time. A crucial role of the EPC BRI plan is to stand in the gap so that the health crisis does not also become a financial crisis. Thank God the resources of our plan—made possible by the members and churches who participate in our plan—were there for these families.

In 2022, COVID was again a factor in our claims cost. The plan experienced claims of $1.4 million (about 9% of all claims) related to COVID testing and treatment.

The virtual care option under the EPC plan is provided by 98point6. We’re pleased to note an increased use of this convenient and effective alternative to a doctor’s office visit. During 2022 there were 668 virtual “office” visits, and the median wait time was only 16 minutes. Your fellow EPC members who used the service gave it a 4.8 out of 5 rating. For more information, see the EPC Benefits website at www.epconnect.org/benefits.

We contract with Meritain Health for administrative services for the medical plans. On calls from EPC members, Meritain’s average speed of answer has been 28 seconds. Further, our members report that their reason for calling is resolved on the first call 99.6% of the time. Members who have questions or experience difficulties can call Meritain at 800-925-2272. If members do not believe Meritain has adequately addressed their issue, they can call the BRI office at 407-930-4492 and BRI staff will assist them. The medical plan uses the Aetna Choice POS II national provider network.

WELLNESS AND MEMBER CARE FOCUS

The health of EPC members is of critical importance to the BRI Board of Directors and the Office of General Assembly. The overall health of membership directly impacts the cost of healthcare covered by the plan, but much more importantly, the health of our members directly impacts the work of caring for and leading EPC congregations in sharing the gospel!

From viewing de-identified claim data from our EPC membership, we learn the following:

• Most (but not all) of us are getting our annual physical, bloodwork, or other age/gender appropriate health screenings. In fact, this last year about 1 in 7 of us did not see our doctor for even the most basic preventative care.

• Mental health continues to be a growing area of concern. 24% of our membership are either receiving some treatment for stress, anxiety, depression, or behavioral health-related condition. If there is good news in this, it is that our members appear to be more willing to seek help with these conditions than people in the general public. However, statisticians would tell us that there are probably more untreated conditions among our membership.

• High blood pressure, high cholesterol, and diabetes continue to be conditions that show up in our EPC plan membership at a higher rate than in the general public. If you have one or more of these conditions, it is imperative that you follow-up with your treatments and screenings.

In response to this, BRI has implemented the Livongo Whole Person Health program to coach and provide practical resources to those with diabetes, pre-diabetes, and high blood pressure. BRI has also added a Nurse Health Coaching program to provide education and support to participants with other conditions such as chronic pain, arthritis, high cholesterol, asthma, and various lung, heart, and kidney diseases. These programs are available at no cost to EPC Plan participants. The EPC Benefits website contains a wealth of information on these programs; see www.epconnect.org/benefits/2023medical. Or log into your Meritain Health account.

• A large portion of healthcare in America is spent at infusion centers, testing labs, imaging centers, and physical therapy offices that are part of a hospital system. Patients often don’t realize that they have a choice of non-hospital facilities to use for these same procedures that offer equivalent quality of service at lower cost and more convenient locations. We encourage you to ask a question or two before you make the choice to spend your money—and the health plan’s money—at the only referral offered. To make it easier for our members to explore facility alternatives, we have introduced Healthcare Bluebook through Meritain Health. These services can direct you to highly ranked facilities in your area for specific medical procedures when that unexpected diagnosis arises. In many cases, Healthcare Bluebook offers a cash incentive to our members who select one of their recommended highly performing centers of excellence for a variety of medical procedures and surgeries. Use the EPC Benefits website or your Meritain account to access Bluebook.

Please, make it a personal goal to take advantage of these important benefits. In order to make sure you do not miss important health management calls from Meritain, we encourage everyone to add Meritain’s main number to their address book: 888-610-0089.

LIFE, VISION, AND DENTAL INSURANCES

Participation in these supplementary benefits has increased steadily over the last several years, with enrollment increases of 5.2% for Life/Disability Insurance, 6.5% in Vision; and 5.0% in Dental in 2023. With inflationary pressures lurking, BRI was able to negotiate a rate increase of 8% for our Dental benefit—locking the rates for 2 years through the end of 2024. The Life/Disability Insurance saw its first rate increase in more than 5 years of 5%. These rates are also fixed now through 2024. The vision insurance rates were unchanged and are also fixed through the end of 2024.

Act of Assembly 81-05 established that Terms of Call for any EPC minister shall provide for life and disability coverages. Over the years as EPC Benefit Resources has made these coverages available to EPC ministers, many have been supported through life insurance proceeds in times of personal loss and through disability payments when an unexpected accident or illness leads to disability. All of these coverages are made available to ministers and staff working 30 or more hours per week.

RETIREMENT PLAN

Overview

As of December 31, 2022, there were 2,438 participants in our defined contribution Retirement Plan. Collectively, our members held over $177 million in their retirement accounts, or an average balance of about $72,000 per participant (as of December 2022). Nearly half of the value of members’ accounts is invested in Retirement Target Date (Life Cycle) funds. These funds automatically and gradually reduce members’ exposure to investment risks as they approach retirement. The increasing use of these funds is a positive trend. In addition to the 12 target date funds, members have the opportunity to invest in a selection of 11 top-rated funds in various asset classes. Another option is investment through the Plan’s self-directed brokerage link, where participants may invest in any publicly traded security—adding hundreds more choices. Participants also have the opportunity to “roll over” funds from their personal IRAs or former employer-based 401(k) or 403(b) plan into their EPC Plan account. Employees and Benefit Administrators can check the EPC website at www.epconnect.org/benefits/2023retirement or call the EPC Benefits Office for information.

Performance

The Investment Committee of BRI meets quarterly with our Retirement Plan consultant to evaluate the performance, expenses, and risk profile of each of the investment options offered under the EPC 403(b)(9) Plan. We feel confident that the funds selected provide the best choices on all three counts. Of the 11 asset class funds available, 7 have exceeded their marketplace benchmark over both 3 and 5 years. Notably, our Investment Committee has placed the T. Rowe Price Growth Fund on a watch list for poor performance. Across the Target Date Funds, there has been a slight underachievement of the Fidelity Funds over a 3-year period, but those funds have a slight edge over their marketplace benchmarks over 5 years. Of our 23 available funds, 22 had lower management expense fees than their marketplace counterparts.

Legislative Changes

Federal regulators occasionally enact legislative changes that can impact plan administration, distribution rules, etc. The BRI office works closely with its Plan Consultant, the Church Benefit Association, and legal counsel to make sure its plan documents are up-to-date and reflect current legislation. The U.S. Congress passed legislation in 2022 known as the “Secure Act 2.0.” Most significantly, we understand that this legislation encourages plans such as ours to open up new distribution options for those in retirement to more effectively manage their income streams from the plan. The impact of this change on our plan is under review, so watch for announcements from the BRI office.

Tax-Advantaged Withdrawals

Because the EPC Retirement Plan is a 403(b)(9) plan, ordained pastors retain the ability to use up to 100% of their annual retirement withdrawals (not to exceed the amount allowable by the IRS) to pay housing expenses exempt from federal income taxes. This continues even into retirement provided the funds were contributed during the pastor’s tenure as minister and have remained in the EPC Plan. This proves to be a significant advantage for EPC pastors over other retirement plans available in the market without this designation.

Fidelity Investments

We continue to partner with Fidelity Investments to administer and advise members on their retirement plan choices. All EPC plan participants are entitled to receive a free review of their investment choices, portfolio performance, and progress toward retirement goals at any time with an Investment Adviser by calling Fidelity at 800-342-0860 to make an appointment. We suggest each of our members do this at least annually. For an additional fee, members can also utilize Fidelity’s Personalized Planning and Advice (PPA) service which offers personalized planning, tracking, and recurring update services with consideration toward all of your financial goals and resources.

Conclusion

There appears to still be about 15% of EPC churches that do not have any pastor or staff participating in our 403(b)(9) Plan. That may be because they feel they have their employee’s retirement funding taken care of in some other way. Or it may be because the employees and Pastor are just part time. Or they simply feel they cannot afford it. We encourage the leadership of those churches to re-consider.

• For a Pastor to take advantage of the housing allowance benefit in retirement, the plan must be a 403(b)(9) Plan, like the EPC’s Plan. It cannot be simply a 403(b) plan.

• Part-time employees are eligible to participate in the EPC Plan, and it is a good tax-advantaged way for them to save for their retirement.

• The future financial cost of a pastor or staff member’s retirement years is a real cost that should be provided for while they are working. We believe that a church that is not considering this cost now and not helping the pastor/employee set aside retirement funds now is being shortsighted. Our Plan offers 23 carefully selected investment options, and a brokerage link that adds a virtually unlimited array of additional investment choices. In addition, investment guidance from licensed financial advisers is available at no cost to the participant.

THE FUTURE

The EPC Benefit plans are in a solid position to provide care and support for our members. Our plans are designed to be a partnership with our churches and members, so we encourage you to take these steps over the next year to ensure our joint success in your heath, wellness, and retirement security:

• If your church does not participate in the EPC Benefit Plans, put that option in front of your leadership by contacting the EPC Benefits office. We are stronger together.

• Make it a personal goal for you, your family, and your staff to get your annual medical checkup (including bloodwork). Follow up with your physician to complete all the recommended health screenings (mammogram, colonoscopy, lung screenings, etc.).

• Add Meritain’s Nurse Coaching phone number (888-610-0089) to your phone’s address book so that you don’t miss any messages regarding their recommendations for your healthcare.

• Make full use of the free Wellness, Member Care, and Disease Management resources and programs available to you as a participant in the EPC Medical Plan. Keep an eye out for BRI newsletters and Meritain Health outreaches. If you do not receive these newsletters, sign up at www.epconnect.org/benefits.

• Set a goal to put 15% of your income away for your retirement. This can be through a combination of church contributions (10% for Pastors required by Acts of the Assembly 81-05) and personal payroll-deducted contributions.

• Consider participating in Fidelity’s Personal Planning and Advice fee service. Or at a minimum, contact Fidelity for a review of your 403(b)(9) account fund selections.

• Review the beneficiary designations for your life insurance and your retirement account.

It is a privilege to serve on the BRI Board of Benefits because the health and retirement plans we oversee are for the benefit of those who serve Christ in the EPC. I want to thank my fellow Board members for their dedicated service.

RECOMMENDATIONS (DETAILED)

RECOMMENDATION 43-12

That ordained ministers drawing retirement income from the EPC 403(b)(9) Defined Contribution Retirement Plan be allowed to designate up to 100% of their retirement income for housing allowance as permitted by applicable regulations adopted pursuant to the Internal Revenue Code.

Rationale: To do so permits retired, ordained ministers to take advantage of this significant tax benefit in retirement, thereby making more of their retirement income available for living expenses. Adopting this recommendation on an annual basis provides retired ministers with a readily available reference if asked by tax authorities.

COMMITTEE MEMBERS

Randy Shaneyfelt (Chairman)

RE, Presbytery of the Great Plains

Bill Reisenweaver

TE, Presbytery of Florida and the Caribbean

Michael Moore

Presbytery of the Central South

Sandy Siegfried

Presbytery of the Great Plains

William Barnes

RE, Presbytery of the West

Jim Levine

RE, Presbytery of the West

Erik Ohman

TE, Presbytery of the West

Stuart VanKirk

RE, Presbytery of the Alleghenies

MEETING DATES

October 5, 2022: Office of the General Assembly (Orlando, Florida)

December 15, 2022: Video Conference

March 10, 2023: Office of the General Assembly (Orlando, Florida)

June 14, 2023: Video Conference

Respectfully submitted,

Randy Shaneyfelt, Chairman

June 2023

Office of the General Assembly

5850 T.G. Lee Blvd., Suite 510

Orlando, FL 32822

(407) 930-4239

(407) 930-4247 fax

info@epc.org